Accessibility Quick Links

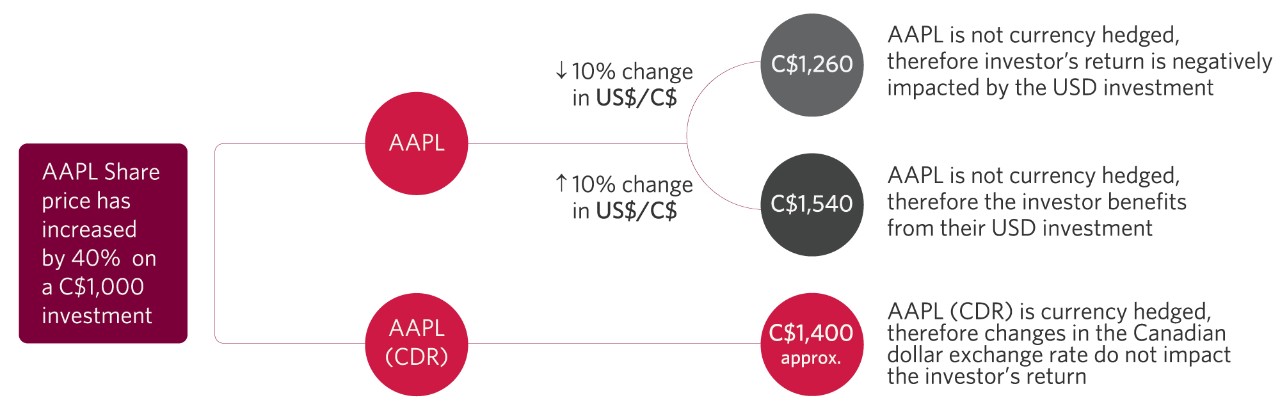

CDRs provide exposure to global companies trading in Canadian dollars on a Canadian stock exchange.

Mar. 04, 2025

Invest in global companies at a fraction of the cost without the currency conversion headache

How do fractional shares work?

How are CDRs priced?

CDRs trade in Canadian dollars — what are the benefits?

Exactly how is foreign currency risk minimized?1

Does the CDR Ratio change?

| Daily USD/CAD Movement | Notional Currency Hedge | CDR Ratio Adjustment |

|---|---|---|

| Canadian Dollar Appreciates versus U.S. Dollar | Positive closing value | CDR Ratio up Therefore, each CDR represents a larger number of underlying shares. |

| Canadian Dollar Depreciates versus U.S. Dollar | Negative closing value | CDR Ratio down Therefore, each CDR represents a smaller number of underlying shares. |

Will the CDR pay dividends?

Will I have voting rights?

How liquid are CDRs?

Are there any fees?

How do I place an order to buy or sell a CDR?